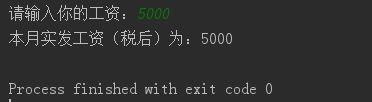

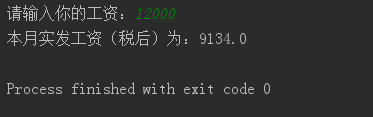

#应纳税的钱:税前收入-5000元(起征点)-专项扣除(五险一金等)#工资个税的计算公式为:#个人所得税=应纳税的钱×适用税率-速算扣除数'''1、全月应纳税所得额不超过3000元:税率:3%; 速算扣除数(元):02、全月应纳税所得额超过3000元至12000元:税率:10%; 速算扣除数(元):2103、全月应纳税所得额超过12000元至25000元:税率:20%; 速算扣除数(元):14104、全月应纳税所得额超过25000元至35000元:税率:25%; 速算扣除数(元):26605、全月应纳税所得额超过35000元至55000元:税率:30%; 速算扣除数(元):44106、全月应纳税所得额超过55000元至80000元:税率:35%; 速算扣除数(元):71607、全月应纳税所得额超过80000元:税率:45%; 速算扣除数(元):15160'''#定义税前工资Tax_salary = int(input("请输入你的工资:"))if Tax_salary > 5000: #应纳税的工资 Taxable_salary = Tax_salary - 5000 - Tax_salary * 0.22 if Taxable_salary <= 3000: # 个人所得税 Personal_income_taxes = Taxable_salary * 0.03 - 0 elif Taxable_salary > 3000 and Taxable_salary <= 12000: Personal_income_taxes = Taxable_salary * 0.1 - 210 elif Taxable_salary > 12000 and Taxable_salary <= 25000: Personal_income_taxes = Taxable_salary * 0.2 - 1410 elif Taxable_salary > 25000 and Taxable_salary <= 35000: Personal_income_taxes = Taxable_salary * 0.25 - 2660 elif Taxable_salary > 35000 and Taxable_salary <= 55000: Personal_income_taxes = Taxable_salary * 0.3 - 4410 elif Taxable_salary > 55000 and Taxable_salary <= 80000: Personal_income_taxes = Taxable_salary * 0.35 - 7160 elif Taxable_salary > 80000: Personal_income_taxes = Taxable_salary * 0.45 - 15160 #五险一金 Five_one_gold = Tax_salary * 0.22 #实发工资 Net_pay = Tax_salary - Personal_income_taxes - Five_one_gold print("本月实发工资(税后)为:{}".format(Net_pay))else: print("本月实发工资(税后)为:{}".format(Tax_salary)) 执行结果演示: